Opening a Bank Account:

There are many banks in Lincoln where you can open a checking or savings account. Many new international students choose to bank at Union Bank because they have a location inside the union on city campus and many ATM's located throughout the campus and downtown. However, there are many other banks close to campus as well. Your choice of bank is up to you. Click HERE for a map of banks close to the UNL city campus.

There are two main types of accounts you can open at the bank, a checking account or a savings account.

| Checking Account | Savings Account |

| A checking account will allow you to transfer money from your bank account to another person or organization by either writing a check or using your debit card. You can also use your debit card to get cash out of an ATM. | A savings account will provide you with a safe place to hold funds that exceed your daily needs. You can take money out of your savings account when you need to and you can also use your debit card at an ATM to get cash out of your savings account. |

Union Bank & Trust (UBT) is the exclusive bank on campus. Banking in the U.S. can be a challenge, but we're here to make it easy for you. We offer a variety of accounts and services to help international students manage their money. Here is some information about banking with UBT that you may find helpful, as an international student.

Opening Your Account

The bank needs the following information to open your account:

- Passport or U.S. government issued ID

- NUID or other address verification (such as a rental lease, bill payment stub, or acceptance letter from UNL)

- SSN, or if you don’t have an SSN we can help you complete an identification form

- Initial deposit to open a checking account is $50, for a savings account it is $25

Once Your Account is Open

- Please let us know before you travel so your debit card can be used on your trip.

- Please let us know if you move or change your phone number.

Visa Debit Cards

Visa Debit Cards give you access to the money in your accounts in a variety of ways.

- Make purchases with your debit card at any merchant that accepts Visa, in person or online.

- When making a purchase the money will always come out of your checking account. Select debit to authorize it with your PIN. Select credit to authorize it with your signature.

- Get cash at an ATM using your PIN. Daily cash withdrawal limit is $300.

- Transfer money between your UBT checking and savings accounts at an ATM.

- Select your PIN when you order your debit card.

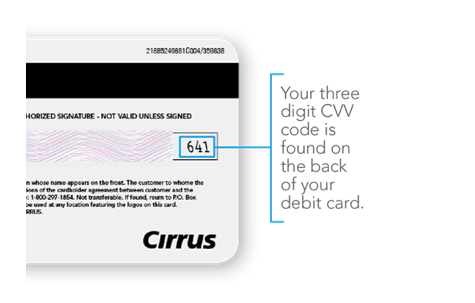

- You may need to enter your debit card CVV code while shopping online.

Check Writing

Checks allow you to pay your bills or other people using the money in your checking account. A check contains all of your account information.

To write a check you will:

- List the name of the person or business you are paying.

- Write the current date.

- Write the amount of the check, in numbers.

- Write the amount of the check, in words.

- Sign the check to authorize it.

- You may write a memo stating what you are paying for, if you like.

Online Account Access

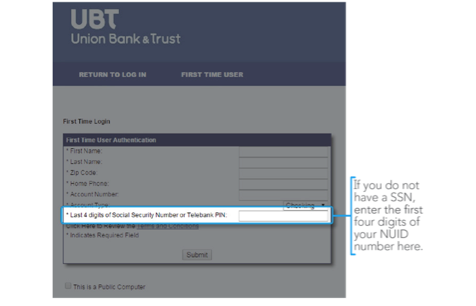

UBT offers free access to your accounts online. To enroll for Online Banking:

- Visit https://www.ubt.com/unl

- Click on “Sign up for Online Banking,” and follow the instructions provided.

- When asked to give your SSN, if you do not have one, enter the first 4 digits of your NUID number.

- The Access ID you choose must have at least 8 characters.

- The Password you choose should have a minimum of 2 uppercase letters, 2 lowercase letters and 2 numbers.

Sending and Receiving Money

The easiest way to send or receive money is by a wire transfer.

Wire Transfer Fees

- Domestic Wire (within the US) - $20 fee

- International Wire (outside the US) -$45 fee + $10 currency rate secure fee

-

Receiving a wire, international or domestic - $12 fee

Receiving Money

In order to receive an international wire transfer, you should provide the following information to the individual sending you money.

Receiving Bank Information:

Union Bank & Trust Co

3643 S 48th Street

Lincoln, NE 68506

Swift code: UNTUUS42

Beneficiary Information:

Account Name: [Your Name]

Address: [Your Address]

Account Number: [Your Account Number]

*Please remind the sender to provide your name and UBT account number in the additional information section of the wire transfer form before they send the wire to you.

Sending Money

To send a wire transfer, you should provide the following information to UBT.

- Information about the person you are sending money to, including: their name, address, bank account number/IBAN

- Information about the bank receiving the wire, including: name, city, state/province, country, swift/BIC

Foreign Cards in the U.S.

Bank Cards: Foreign debit cards or bank cards can be difficult to use in the U.S., since many ATMs and merchants do not accept them. Instead, bring your credit card which can be more widely accepted.

Credit Cards: Before you use your foreign credit card in the U.S. be sure that you know your credit limit, cash advance limit and fees for purchases and cash advance.

Help

Do you have any questions about banking with UBT? Click here for more information about how we can help you manage your money.